Metatrader 4 is actually a well-liked investing system among dealers around the world. This effortless-to-use and highly effective platform offers sophisticated charting tools, signs, and buying and selling capabilities that allow investors to get into the worldwide market segments and business various assets through the comfort of their home. In order to grasp

Metatrader 4, this complete manual offers you all of the vital info and move-by-step guidelines you need to turn into a proficient forex trader on this program.

1. Understanding the Metatrader 4 Program

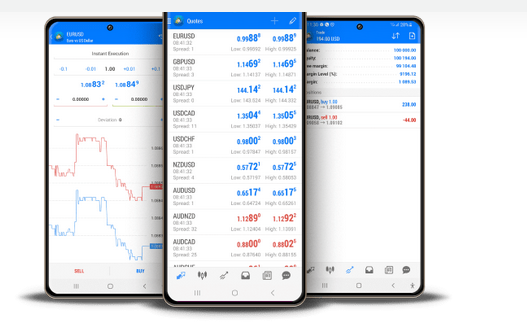

The Metatrader 4 graphical user interface might appear overpowering initially, but it’s easy to navigate once you understand its format. The platform’s main windowpane is divided into a number of portions, for example the Market place Observe, Navigator, Terminal, and Graph microsoft windows.

The Current Market View windowpane screens various industry equipment as well as their prices, letting you monitor the resources you’re enthusiastic about. The Navigator windows displays your account information, signs, and expert experts. The Terminal windowpane is where you can control your investments, view your account record, and entry the platform’s various capabilities.

The Graph or chart windows is where you can look at the price actions of your particular asset and assess its tendencies. The graph windows delivers a variety of personalization alternatives that allow you to alter the chart’s colours, timeframes, and indications. Learning the Metatrader 4 interface is the first step toward learning to be a efficient investor about this foundation.

2. Using Indications to Analyze Market Tendencies

Indications are crucial resources for examining market place tendencies and making profitable trading decisions. The Metatrader 4 program offers a variety of indicators, which includes transferring averages, Bollinger groups, MACD, and RSI. These signs provide beneficial information into the market’s tendencies, volatility, and momentum.

To make use of signs, you must affix those to the chart windowpane of the specific advantage. You are able to customize the indicator’s adjustments, including timeframe, period, and color. By inspecting the indicators’ signals, you possibly can make knowledgeable buying and selling choices and increase your profits.

3. Putting and Handling Deals

Placing and dealing with deals in the Metatrader 4 foundation is straightforward. To open up a trade, you need to find the resource you wish to trade, go into the trade’s size and direction, and set up your quit loss and acquire income ranges. You can even use pending orders to open trades automatically at a distinct selling price stage.

Managing transactions in the system is additionally effortless. You can adjust your trade’s end loss, consider profit, and trailing quit amounts at any moment. You may also close your transactions manually or put in place intelligent cease reduction and consider revenue levels.

4. Employing Skilled Experts to Systemize Your Trading

Skilled Experts (EAs) are computerized buying and selling algorithms which can help you improve your buying and selling and optimize your profits. The Metatrader 4 foundation delivers a wide array of EAs, including scalping robots, craze-subsequent robots, and hedging robots.

To utilize EAs, you need to affix them to the graph or chart windows of the certain resource. It is possible to customize the EA’s settings, including entrance and get out of rules, end loss and take income degrees, and risk administration parameters. After you initialize the EA, it is going to automatically close and open trades depending on its algorithm.

5. Working On Your Trading Method

Growing your buying and selling strategy is important to being a productive investor in the Metatrader 4 platform. Your buying and selling approach will include your investing desired goals, risk management prepare, buying and selling timeframe, and advantage choice requirements.

To develop your trading approach, you need to analyze the market’s developments, study your investing background, and backtest your methods. The Metatrader 4 system provides a wide array of backtesting resources that allow you to try out your buying and selling methods on historic information.

Verdict:

Mastering the Metatrader 4 foundation is vital for anyone who wants to buy and sell the global trading markets and increase their income. By comprehending the platform’s program, making use of indications to assess market place developments, positioning and managing deals, utilizing expert analysts to systemize your trading, and developing your buying and selling method, you are able to develop into a proficient dealer on this system. With this particular complete guideline, you possess all the vital info and move-by-phase guidelines you should begin your trip being a productive Metatrader 4 forex trader.